Suchergebnis Auf Amazon.de Für: Elektronische Dartboards - Elektronische Dartboards / Dartboards: Sport & Freizeit

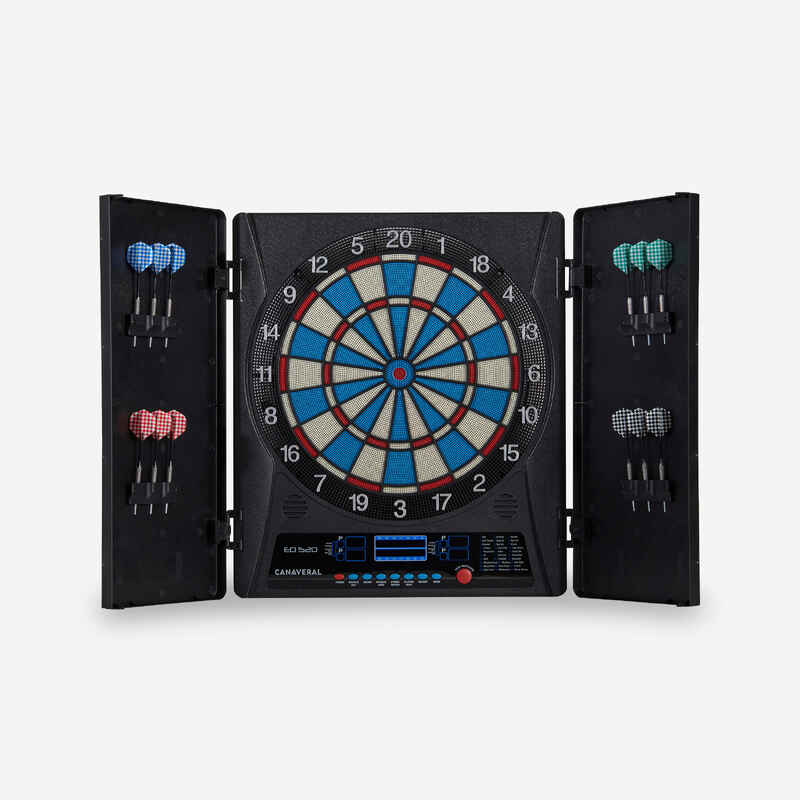

Elektronische Dartscheibe Bull Legend Kabinett Dartschrank 1-8 Spieler mit Softdart Pfeilen & Netzteil (Dart-Kabinett Bull Legend) : Amazon.de: Sport & Freizeit

Elektronische Dartscheibe, Elektrische Digitale Dartscheiben mit 3 Dartpfeilen +12 Ersatz-Dartkopf, Klein Dartscheiben-Set mit LCD-Display für 1 Bis 8 Spieler(26cm, Batterie Nicht enthalten) : Amazon.de: Sport & Freizeit

Elektronische Dartscheibe, Elektrische Digitale Dartscheiben mit 3 Dartpfeilen +12 Ersatz-Dartkopf, Klein Dartscheiben-Set mit LCD-Display für 1 Bis 8 Spieler(26cm, Batterie Nicht enthalten) : Amazon.de: Sport & Freizeit

Suchergebnis Auf Amazon.de Für: Elektronische Dartboards - Elektronische Dartboards / Dartboards: Sport & Freizeit

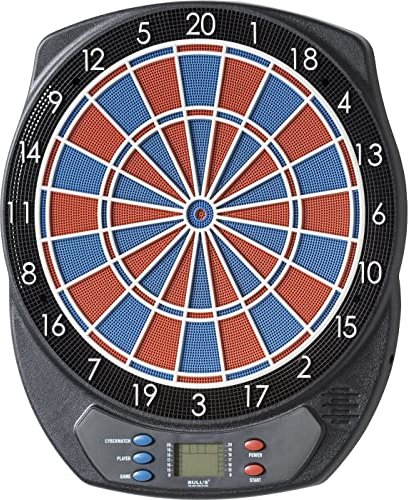

Carromco Dartboard Score-301 - Elektronische Dartscheibe mit Pfeilen - Dart Set für 1-8 Spieler, 26 Spiele und 523 Varianten, Dart Spiel mit LCD Display und 4-Loch Abstand, inkl. 6 Softdarts : Amazon.de: Sport & Freizeit

Elektronische Dartscheibe, Elektrische Digitale Dartscheiben mit 3 Dartpfeilen +12 Ersatz-Dartkopf, Klein Dartscheiben-Set mit LCD-Display für 1 Bis 8 Spieler(26cm, Batterie Nicht enthalten) : Amazon.de: Sport & Freizeit

Elektronische Dartscheibe Bull Legend Kabinett Dartschrank 1-8 Spieler mit Softdart Pfeilen & Netzteil (Dart-Kabinett Bull Legend) : Amazon.de: Sport & Freizeit

Carromco Elektronische Dartscheibe CLASSIC MASTER 2 - Dartboard für 1-8 Spieler - E-Dartautomat mit 6 LED-Anzeigen, 36 Spielen und 585 Varianten - inkl. Netzteil und 6 Softdarts : Amazon.de: Sport & Freizeit

Suchergebnis Auf Amazon.de Für: Elektronische Dartboards - Elektronische Dartboards / Dartboards: Sport & Freizeit

Elektronische Dartscheibe, Elektrische Digitale Dartscheiben mit 3 Dartpfeilen +12 Ersatz-Dartkopf, Klein Dartscheiben-Set mit LCD-Display für 1 Bis 8 Spieler(26cm, Batterie Nicht enthalten) : Amazon.de: Sport & Freizeit

Elektronische Dartscheibe, Elektrische Digitale Dartscheiben mit 3 Dartpfeilen +12 Ersatz-Dartkopf, Klein Dartscheiben-Set mit LCD-Display für 1 Bis 8 Spieler(26cm, Batterie Nicht enthalten) : Amazon.de: Sport & Freizeit

CyeeLife Elektronisch Dartscheibe mit 12 Dartpfeile Set und Zubehör,Batterie/Adapter/deutsch-English 3-Sprachenwechsel,ZD01G : Amazon.de: Sport & Freizeit

Elektronische Dartscheibe Bull Legend Kabinett Dartschrank 1-8 Spieler mit Softdart Pfeilen & Netzteil (Dart-Kabinett Bull Legend) : Amazon.de: Sport & Freizeit