Violetta zu sein ist einfach wunderbar: Ein personalisiertes (DIY) eigenes lustiges Tagebuch : Bookaful Press: Amazon.de: Bücher

Disney Violetta Mein Tagebuch 3: Freunde seit 3 Jahren: Freunde seit 3 Jahren. Mit einem Vorwort von Martina Stoessel : Disney: Amazon.de: Bücher

Disney Violetta Mein Tagebuch 3: Freunde seit 3 Jahren: Freunde seit 3 Jahren. Mit einem Vorwort von Martina Stoessel : Disney: Amazon.de: Bücher

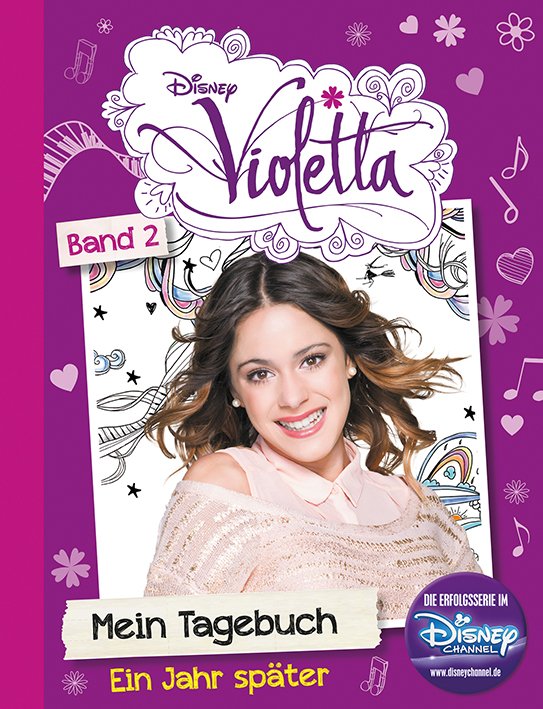

Disney Violetta Mein Tagebuch Band 2: Ein Jahr später : Parragon, Susanne Schmidt-Wussow: Amazon.de: Bücher

Disney Violetta Mein Tagebuch Band 2: Ein Jahr später : Parragon, Susanne Schmidt-Wussow: Amazon.de: Bücher

Violetta: Meine Welt: Basierend auf der TV-Serie: Die Erfolgsserie im Disney Channel : Disney: Amazon.de: Bücher

Disney Violetta Mein Tagebuch Band 2: Ein Jahr später : Parragon, Susanne Schmidt-Wussow: Amazon.de: Bücher

Disney Violetta Mein Tagebuch Band 2: Ein Jahr später : Parragon, Susanne Schmidt-Wussow: Amazon.de: Bücher