Piko 37125 Start-Set BR 80 mit 2 Personenwagen der DR Spur G Epoche III (inklusive Sound + Dampf) : Amazon.de: Baumarkt

Language_Tag:fr_FR,$ims_State:(Value:Approved,Changed_at_Version:1145),Value: Piko 57113 Kit Train de Marchandises Tenderlok + surmatelas,$ims_Sources:[(Customer_id:11,Merchant_SKU:B08563SWGT,ve : Amazon.de: Spielzeug

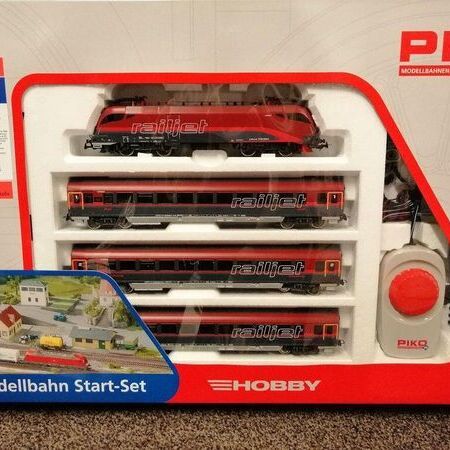

Suchergebnis Auf Amazon.de Für: Startersets Für Modelleisenbahnen - Piko / Startersets Für Modelleisenbahnen / M...: Spielzeug

Suchergebnis Auf Amazon.de Für: Startersets Für Modelleisenbahnen - Startersets Für Modelleisenbahnen / Modellei...: Spielzeug

Language_Tag:fr_FR,$ims_State:(Value:Approved,Changed_at_Version:1145),Value: Piko 57113 Kit Train de Marchandises Tenderlok + surmatelas,$ims_Sources:[(Customer_id:11,Merchant_SKU:B08563SWGT,ve : Amazon.de: Spielzeug

Piko 37125 Start-Set BR 80 mit 2 Personenwagen der DR Spur G Epoche III (inklusive Sound + Dampf) : Amazon.de: Baumarkt

Piko 37125 Start-Set BR 80 mit 2 Personenwagen der DR Spur G Epoche III (inklusive Sound + Dampf) : Amazon.de: Baumarkt

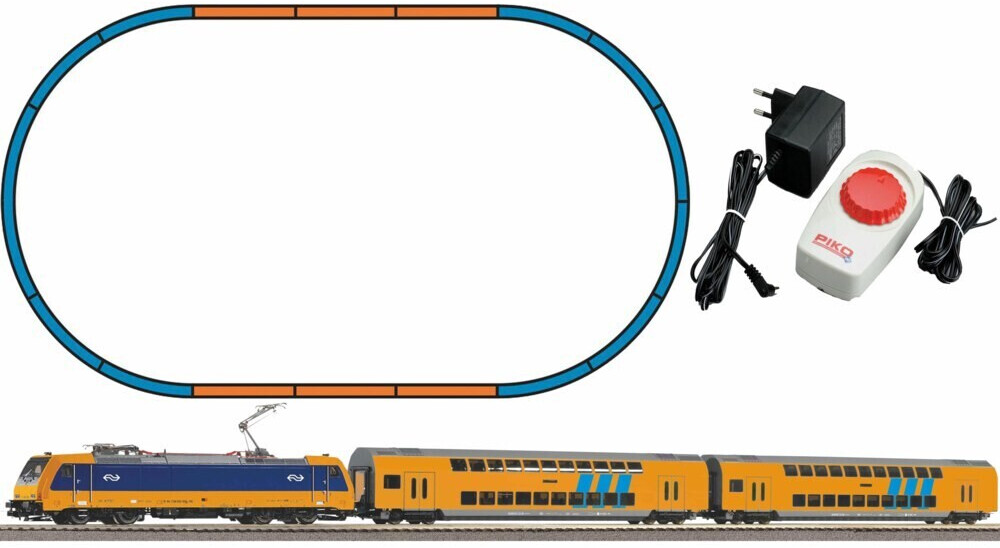

Piko Start-Set mit Bettung Personenzug E-Lok und 2 Doppelstockwagen (97939) ab 125,66 € | Preisvergleich bei idealo.de

Suchergebnis Auf Amazon.de Für: Startersets Für Modelleisenbahnen - Piko / Startersets Für Modelleisenbahnen / M...: Spielzeug